Browsing the Registration Refine for Medicare Benefit Insurance Policy

As individuals come close to the stage of thinking about Medicare Advantage insurance coverage, they are met with a labyrinth of choices and policies that can often really feel frustrating. Allow's explore how to successfully browse the enrollment procedure for Medicare Advantage insurance policy.

Qualification Demands

To receive Medicare Advantage insurance coverage, individuals need to meet particular eligibility needs described by the Centers for Medicare & Medicaid Provider (CMS) Eligibility is largely based upon factors such as age, residency condition, and registration in Medicare Part A and Part B. Many individuals aged 65 and older get Medicare Advantage, although specific individuals under 65 with qualifying disabilities might also be qualified. Furthermore, people need to live within the solution area of the Medicare Advantage strategy they want to sign up in.

Additionally, individuals should be enrolled in both Medicare Part A and Part B to be qualified for Medicare Benefit. Medicare advantage plans near me. Medicare Advantage strategies are needed to cover all services given by Original Medicare (Part A and Part B), so registration in both components is required for people looking for insurance coverage through a Medicare Benefit strategy

Protection Options

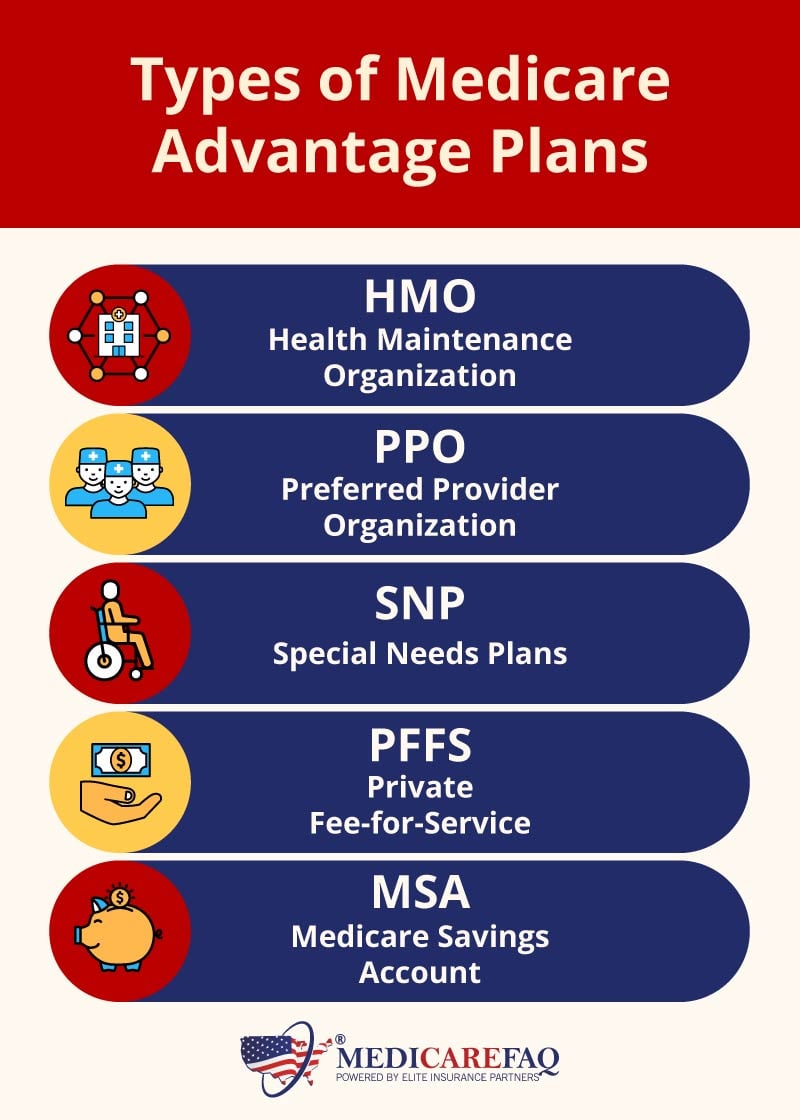

Having satisfied the eligibility needs for Medicare Benefit insurance policy, individuals can now check out the various insurance coverage choices readily available to them within the plan. Medicare Advantage prepares, also known as Medicare Component C, provide an "all-in-one" option to Original Medicare (Part A and Component B) by providing fringe benefits such as prescription medicine insurance coverage (Part D), vision, oral, hearing, and health care.

One of the key insurance coverage alternatives to take into consideration within Medicare Benefit intends is Wellness Upkeep Organization (HMO) plans, which commonly need individuals to select a primary care physician and acquire referrals to see professionals. Special Requirements Strategies (SNPs) cater to individuals with particular health problems or those that are dually eligible for Medicare and Medicaid.

Comprehending these insurance coverage alternatives is crucial for people to make educated decisions based upon their medical care needs and preferences.

Registration Durations

Actions for Registration

Understanding the enrollment durations for Medicare Benefit insurance is critical for recipients to browse the process successfully and successfully, which begins with taking the essential actions for enrollment. You must be registered in Medicare Part A and Component B to qualify for a Medicare Advantage plan.

You can sign up straight via the insurance company using the strategy, via Medicare's website, or by speaking to Medicare straight. Be sure to have your Medicare card and individual info prepared when signing up.

Tips for Choice Making

When evaluating Medicare Benefit plans, it is vital to meticulously assess your private medical care requirements and monetary factors to consider to make an educated decision. To assist in this procedure, think about the complying with pointers for decision making:

Compare Plan Options: Research available Medicare Benefit prepares in your area. Compare their prices, protection advantages, supplier networks, and high quality scores to determine which straightens best with your requirements.

Think About Out-of-Pocket Costs: Look past the monthly costs and take into consideration aspects have a peek at this site like deductibles, copayments, and coinsurance. Calculate possible yearly expenses based on your health care use to find one of the most affordable alternative.

Evaluation Celebrity Rankings: Medicare appoints celebrity rankings to Advantage intends based upon variables like consumer complete satisfaction and high quality of treatment. Choosing a highly-rated plan may suggest far better general efficiency and solution.

Final Thought

In verdict, understanding the eligibility demands, protection choices, enrollment periods, and steps for signing up in Medicare Benefit insurance policy is important for making educated decisions. By navigating the registration procedure properly and thinking about all offered information, individuals can ensure they are picking the most effective strategy to satisfy their medical care requires. Making informed choices throughout the registration procedure can result in better health outcomes and economic protection in the future.